According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $50

- PRO Trader

- MetaTrader4

- MetaTrader5

- AppTrader

- FSCA

- SCA

- 2006

Our Evaluation of Moneta Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Moneta Markets is a moderate-risk broker with the TU Overall Score of 6.98 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Moneta Markets clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Moneta Markets offers a large choice of financial instruments and low trading fees by using ECN (Electronic Communication Network) technology.

Brief Look at Moneta Markets

Moneta Markets has provided its services in financial markets for over 10 years. It offers more than 1,000 trading instruments, including currency pairs, 700+ CFDs on stocks, indices, commodities, bonds, and ETFs (exchange-traded funds). This broker is regulated by the Financial Services Conduct Authority of South Africa (FSCA), license number 47490.

Moneta Markets boasts over 70,000 trading accounts and processes more than 1.5 million trades totaling $100 billion each month. The broker caters to both active traders and passive investors who favor social trading.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Minimum deposit is only $50;

- Three account types that are suitable for both novice traders and professionals;

- Demo account for novice traders to test trading conditions and strategies;

- Possibility of passive income by connecting to social trading services;

- Negative balance protection.

- Small choice of payment methods for depositing and withdrawing funds;

- No cent accounts for trading with reduced risks.

TU Expert Advice

Financial expert and analyst at Traders Union

Moneta Markets has been on the Forex market for more than 10 years and has received many international awards for the quality of its services, client-oriented approach, and introduction of innovative technologies. One of the main advantages of this company, in addition to reduced trading fees, is the use of ECN/STP (straight-through processing) technologies, which provide for getting direct access to liquidity providers with favorable prices and fast order processing for this broker's clients.

Moneta Markets has three standard account types with optimal conditions for novice traders, professionals, and copy traders. The minimum deposit is $50, leverage is up to 1:1000, trading fees are from $0-$3, and spreads are from 0-1.2 pips, subject to the account type. This broker does not prohibit the use of any trading strategies, advisors, or copy trading services.

This brokerage company focuses on the transparency of its trading conditions, so all information about assets is available in the “Spreads and Commissions” section. Moneta Markets has a fairly informative educational and news section, where both novice traders and professionals can find many useful materials. This broker offers profitable partnership programs with rewards for conversions and fees for the trading volume of attracted clients.

- You are interested in trading with very high leverage. Moneta Markets offers up to 1,000x leverage on all accounts.

- You want to trade on ECN accounts. Moneta Markets provides experienced traders with access to very low spreads, starting from 0.0 pips, to reduce trading costs. While there is a commission per lot on ECN, it is relatively low at $1 or $3 per side depending on the account type.

- You trade across multiple markets and want accounts in different currencies. The broker offers accounts in USD, EUR,GBP, AUD, CAD, JPY, SGD, NZD, HKD, and BRL, helping you save on conversion fees.

- You're looking for a broker to invest in managed accounts or ready-made asset portfolios. Moneta Markets currently doesn't nor diversified baskets of financial instruments.

Moneta Markets Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

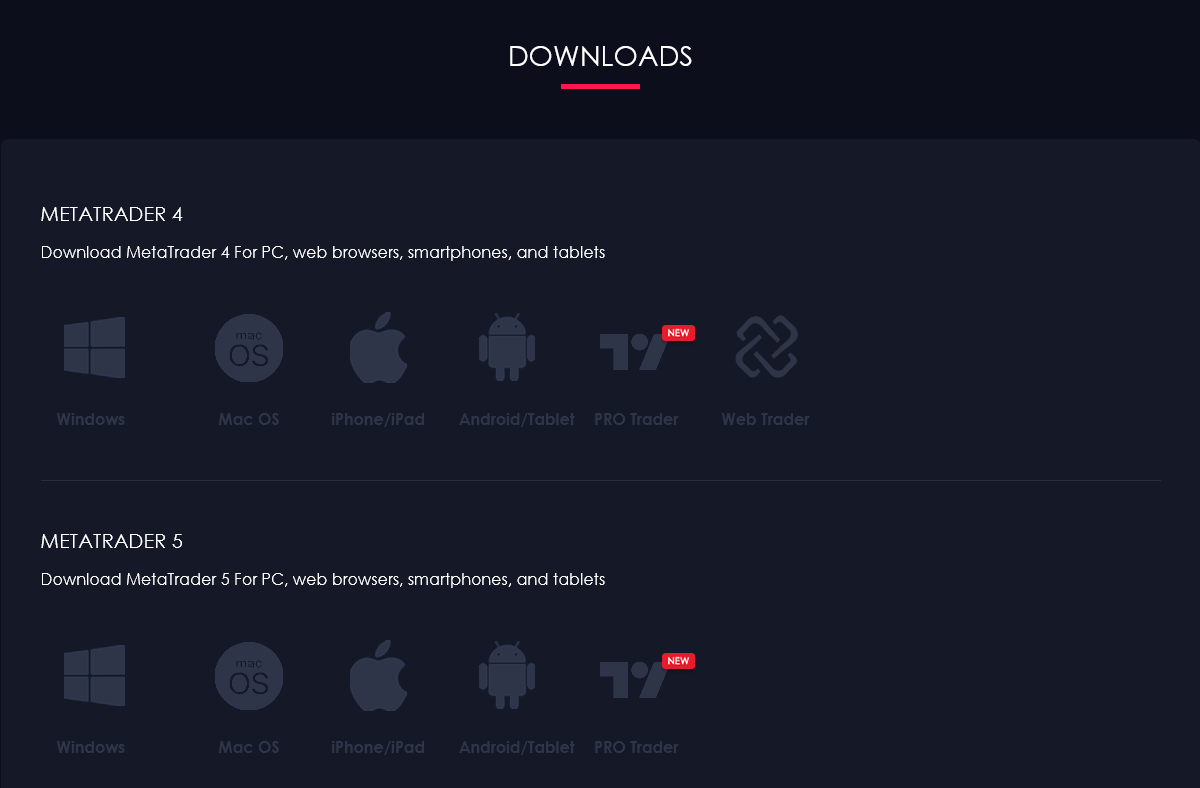

| 💻 Trading platform: | МetaТrader 4/5 (desktop, mobile, and web versions), ProTrader, and AppTrader |

|---|---|

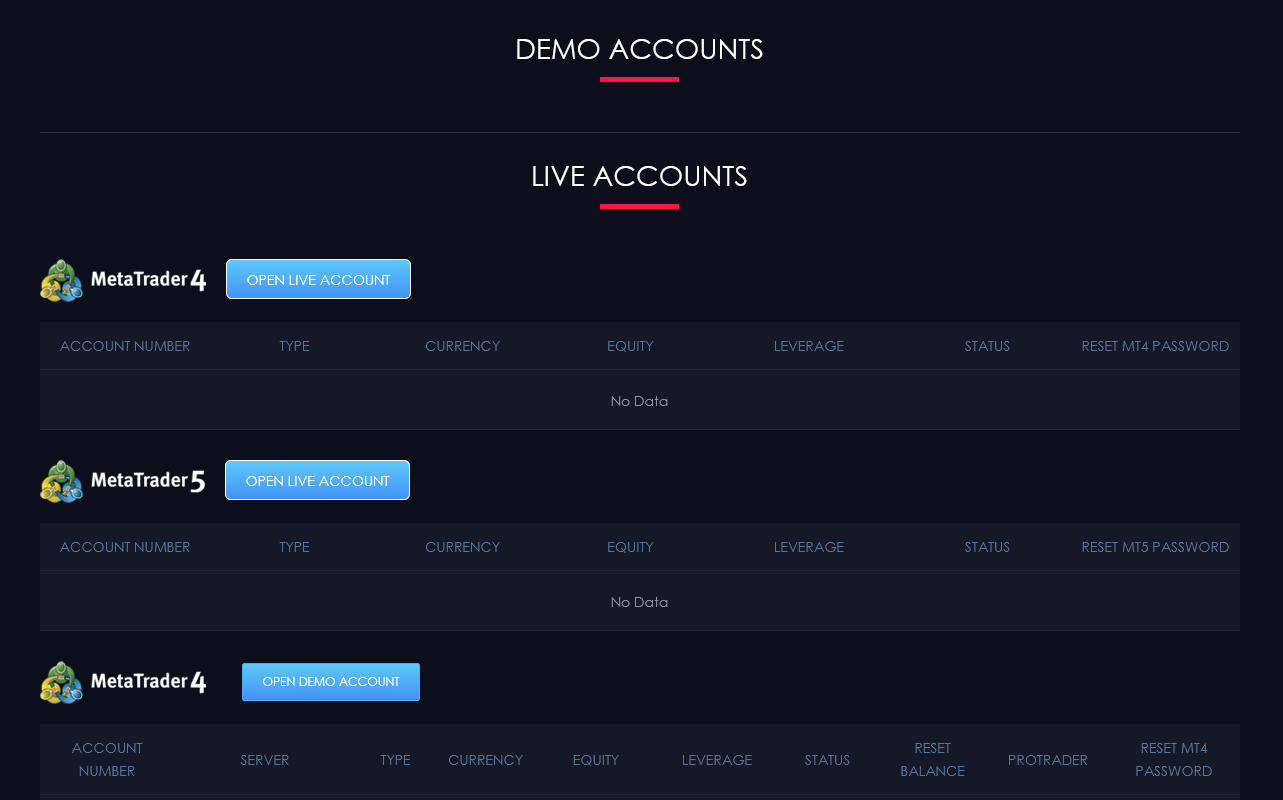

| 📊 Accounts: | Demo, Ultra, Prime, and Direct |

| 💰 Account currency: | AUD, USD, GBP, EUR, SGD, CAD, NZD, JPY, HKD, and BRL |

| 💵 Deposit / Withdrawal: | Wire transfers, bank cards, FasaPay, JCB, and STICPAY |

| 🚀 Minimum deposit: | $50 |

| ⚖️ Leverage: | Up to 1:1000 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,3 pips |

| 🔧 Instruments: | 45 currency pairs, 700+ CFDs on stocks, 16 indices, 19 commodities, 7 bonds, 30+ cryptocurrencies, and 50+ ETFs |

| 💹 Margin Call / Stop Out: | No/50% |

| 🏛 Liquidity provider: | Own liquidity providers |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | STP and ECN |

| ⭐ Trading features: | Copy trading and hedging are allowed |

| 🎁 Contests and bonuses: | 25% Rescue Bonus, recurring bonuses in the form of rebates from TU |

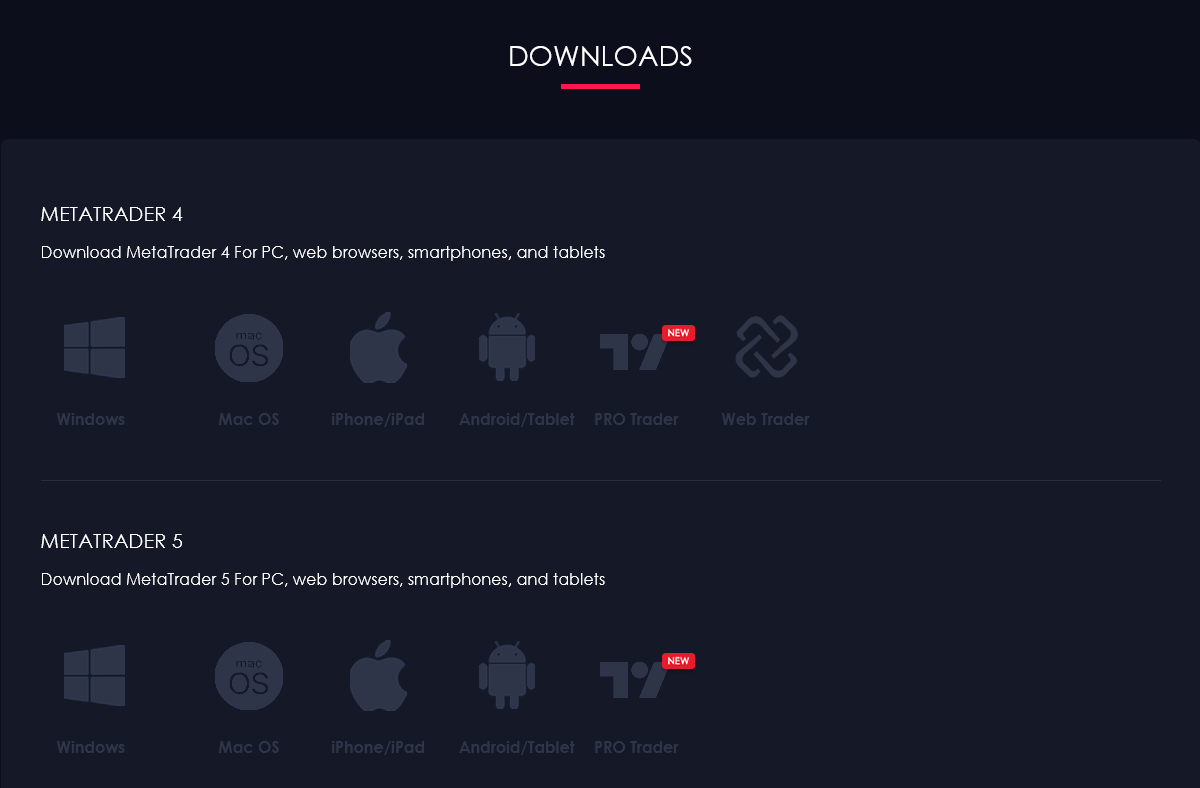

Moneta Markets offers such popular trading platforms as MetaTrader 4 and MetaTrader 5, ProTrader, and AppTrader for working on PCs and mobile devices. This company has three standard account types and a variety of financial instruments with different trading fees and spreads. The maximum leverage for all account types is 1:1000. The minimum deposit is $50.

Moneta Markets offers two trade order execution models: STP and ECN. STP allows for commission-free trades, with only the trading spread as a cost. ECN, designed for professional traders, scalpers, and algorithmic traders using Expert Advisors, provides tighter spreads but includes a commission per lot.

Moneta Markets also caters to Muslim traders with Islamic accounts, enabling Sharia-compliant trading without Swap commissions. Other account types offer both negative and positive swaps, allowing traders to potentially earn additional profits from position rollovers, alongside the risk of losses.

Moneta Markets provides some of the highest leverage in the market, while also managing the inherent risks of margin trading. The company offers negative balance protection and limits leverage for volatile instruments like stock and cryptocurrency CFDs. Moneta Markets offers Zulu Trader and CopyTrader app, as well as MAM and PAMM accounts.

Moneta Markets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

TJ Dushanbe

TJ Dushanbe  KE Nairobi

KE Nairobi  US Los Angeles

US Los Angeles  AZ Baku

AZ Baku  PK Islamabad

PK Islamabad The broker provides a good job to the trader

HFT trading is not supported by the broker

PK Islamabad

PK Islamabad Good trading conditions

To test the broker's work you need to pass verification in the company

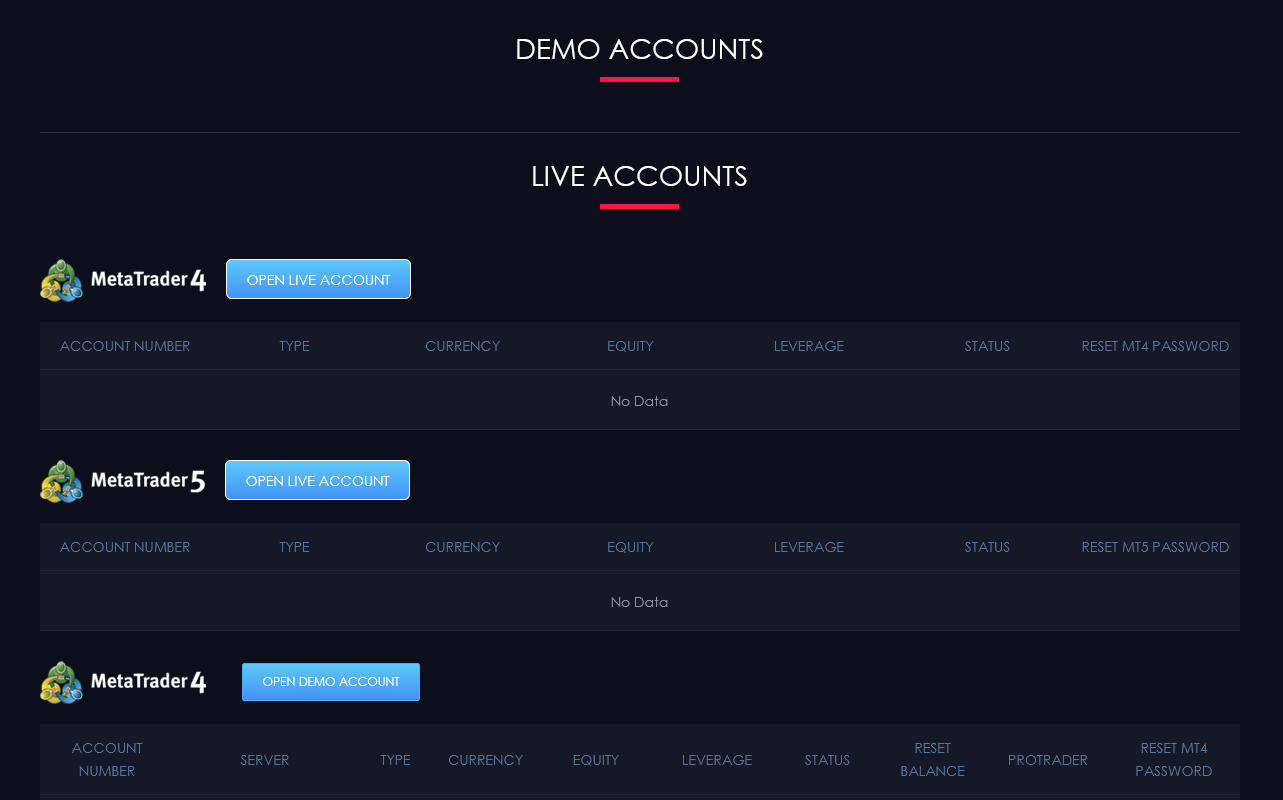

Trading Account Opening

To trade through Moneta Markets, register on its website and open a trading account. Below are the instructions for registration and the user account:

On the Moneta Markets website, click the “Sign Up” button.

Select your country, an individual or corporate account type, enter your first and last names, email, and phone number, then click the “Next” button. Learn important information about this broker’s regulator and click the “Continue” button.

Options available in Moneta Markets’ user account:

Additional features of the user account:

-

Professional trading tools;

-

History of financial transactions;

-

Contact technical support;

-

Information about open accounts;

-

Deposits and withdrawals;

-

Technical analysis;

-

Language selection.

Regulation and safety

Moneta Markets has a safety score of 7.1/10, which corresponds to a Medium security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Track record over 19 years

- Not tier-1 regulated

Moneta Markets Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FSCA SA FSCA SA |

Financial Sector Conduct Authority of South Africa | South Africa | No specific fund | Tier-2 |

| ESCA (UAE) | Emirates Securities and Commodities Authority | United Arab Emirates | Varies depending on the case, no fixed limit. | Tier-2 |

Moneta Markets Security Factors

| Foundation date | 2006 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Moneta Markets have been analyzed and rated as Medium with a fees score of 6/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Moneta Markets with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Moneta Markets’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Moneta Markets Standard spreads

| Moneta Markets | Pepperstone | OANDA | |

| EUR/USD min, pips | 1,2 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,8 | 1,5 | 0,5 |

| GPB/USD min, pips | 1,2 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,8 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Moneta Markets RAW/ECN spreads

| Moneta Markets | Pepperstone | OANDA | |

| Commission ($ per lot) | 3 | 3 | 3,5 |

| EUR/USD avg spread | 0,3 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,4 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Moneta Markets. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Moneta Markets Non-Trading Fees

| Moneta Markets | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

Moneta Markets offers three standard account types and a demo account. The maximum trading leverage on all accounts is 1:1000. The minimum deposit, fees, and spreads depend on the account type. The minimum trading volume is 0.01 lots. All STP and ECN Direct accounts can be turned into Islamic accounts. Each client can have several accounts of different types.

Account types:

Before opening a live account, a trader can request a demo account and use it for trading in the simulator using virtual funds. Demo accounts will automatically deactivate if not used for 30 days.

Unlike any other brokers, the same number of trading instruments is available on all Moneta Markets accounts, which allows both beginners and experienced traders to trade without restrictions.

Moneta Markets is a broker with reduced spreads and trading fees, which is achieved by working directly with liquidity providers using ECN and STP technologies.

Deposit and withdrawal

Moneta Markets received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

Moneta Markets provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- Bank wire transfers available

- Minimum deposit below industry average

- Supports 5+ base account currencies

- No withdrawal fee

- USDT payments not accepted

- PayPal not supported

- Limited deposit and withdrawal flexibility, leading to higher costs

What are Moneta Markets deposit and withdrawal options?

Moneta Markets provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire.

Moneta Markets Deposit and Withdrawal Methods vs Competitors

| Moneta Markets | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are Moneta Markets base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Moneta Markets supports the following base account currencies:

What are Moneta Markets's minimum deposit and withdrawal amounts?

The minimum deposit on Moneta Markets is $50, while the minimum withdrawal amount is $50. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Moneta Markets’s support team.

Markets and tradable assets

Moneta Markets provides a standard range of trading assets in line with the market average. The platform includes 1000 assets in total and 60 Forex currency pairs.

- Copy trading platform

- Passive income with bonds

- ETFs investing

- Regional restrictions are possible

Supported markets vs top competitors

We have compared the range of assets and markets supported by Moneta Markets with its competitors, making it easier for you to find the perfect fit.

| Moneta Markets | Plus500 | Pepperstone | |

| Currency pairs | 60 | 60 | 90 |

| Total tradable assets | 1000 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Moneta Markets offers for beginner traders and investors who prefer not to engage in active trading.

| Moneta Markets | Plus500 | Pepperstone | |

| Bonds | Yes | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Trading platforms & tools

Moneta Markets received a score of 9/10, indicating a strong offering in terms of trading platforms and tools. The broker provides broad access to popular platforms and supports a variety of features designed to enhance both manual and automated trading.

- Trading bots (EAs) allowed

- Proprietary platform with unique features

- One-click trading

- Free VPS for uninterrupted trading

- No access to API

- No access to cTrader and its advanced tools.

- No TradingView integration

Supported trading platforms

Moneta Markets supports the following trading platforms: MT4, MT5, Proprietary platform, WebTrader. This selection covers the basic needs of most retail traders. We also compared Moneta Markets’s platform availability with that of top competitors to assess its relative market position.

| Moneta Markets | Plus500 | Pepperstone | |

| MT4 | Yes | No | Yes |

| MT5 | Yes | No | Yes |

| cTrader | No | No | Yes |

| TradingView | No | Yes | Yes |

| Proprietary platform | Yes | Yes | Yes |

| NinjaTrader | No | No | No |

| WebTrader | Yes | Yes | Yes |

Key Moneta Markets’s trading platform features

We also evaluated whether Moneta Markets offers essential trading features that enhance user experience, accommodate various trading styles, and improve overall functionality.

Supported features

| 2FA | Yes |

| Alerts | Yes |

| Trading bots (EAs) | Yes |

| One-click trading | Yes |

| Scalping | Yes |

| Supported indicators | 100 |

| Tradable assets | 1000 |

Additional trading tools

Moneta Markets offers several additional features designed to enhance the trading experience. These tools provide greater automation, deliver advanced market insights, and help improve trade execution.

Moneta Markets trading tools vs competitors

| Moneta Markets | Plus500 | Pepperstone | |

| Trading Central | No | No | No |

| API | No | No | Yes |

| Free VPS | Yes | No | Yes |

| Strategy (EA) builder | No | No | Yes |

| Autochartist | Yes | No | Yes |

Mobile apps

Moneta Markets supports mobile trading, offering dedicated apps for both iOS and Android. Moneta Markets received 4/10 in this section, which suggests limited user interest or weak performance of the apps.

- Indicators supported

- Mobile alerts supported

- Supports mobile 2FA

- Low app installs across iOS and Android

- Weak user feedback on Android

We compared Moneta Markets with two top competitors by mobile downloads, app ratings, 2FA support, indicators, and trading alerts.

| Moneta Markets | Plus500 | Pepperstone | |

| Total downloads | 10,000 | 10,000,000 | 100,000 |

| App Store score | No data | 4.7 | 4.0 |

| Google Play score | No data | 4.4 | 4.0 |

| Mob. 2FA | Yes | Yes | Yes |

| Mob. Indicators | Yes | Yes | Yes |

| Mob. Alerts | Yes | Yes | Yes |

Education

The Moneta Markets website has an informative educational section that will help novice traders quickly get used to the world of financial markets.

This company's clients do not have the opportunity to trade on cent accounts, so it is recommended to open a demo account for trading virtual currency without risking real money.

Customer support

Support managers are available 24/5.

Advantages

- Non-clients of this broker can contact support via live chat

- Client support is available in 13 languages

Disadvantages

- Feedback form is not available

- Support works 24/5

This broker provides the following communication channels:

-

telephone;

-

live chat;

-

email.

This broker has its profiles on Instagram, Facebook, YouTube, LinkedIn, and X, where you can also find a lot of useful information and ask questions.

Contacts

| Foundation date | 2006 |

|---|---|

| Registration address | Moneta Markets South Africa (Pty) Ltd, 1 Hood Avenue, Rosebank, Johannesburg, Gauteng 2196, South Africa |

| Regulation |

FSCA, SCA

Licence number: 47490 |

| Official site | https://www.monetamarkets.com/ |

| Contacts |

+61 2 8330 1233

|

Comparison of Moneta Markets with other Brokers

| Moneta Markets | Eightcap | XM Group | RoboForex | LiteFinance | NPBFX | |

| Trading platform |

AppTrader, MetaTrader4, MetaTrader5, PRO Trader | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5, MultiTerminal, Sirix Webtrader | MT4 |

| Min deposit | $50 | $100 | $5 | $10 | $10 | $10 |

| Leverage |

From 1:1 to 1:1000 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:200 to 1:1000 |

| Trust management | No | No | No | No | Yes | No |

| Accrual of % on the balance | No | No | No | 10.00% | 7.00% | No |

| Spread | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0.5 points | From 0.4 points |

| Level of margin call / stop out |

No / 50% | 80% / 50% | 100% / 50% | 60% / 40% | 50% / 20% | No / 30% |

| Order Execution | STP, ECN | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Instant Execution, Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | Yes | No |

Detailed review of Moneta Markets

Moneta Markets positions itself as a reliable service provider with a large choice of financial instruments. This company has received numerous international awards, including the Best Client Support Award, the Best Forex Broker Award, the Most Advanced CFD Trading Platform Award, etc. This broker allows the use of any trading strategies and social platforms. Three standard account types and Islamic and demo accounts are available to its clients. This company also has many useful tools and a finance news section.

Moneta Markets by the numbers:

-

10+ years of successful Forex work;

-

70,000+ open client accounts;

-

Monthly trading volume is $100+ billion;

-

1,500,000+ transactions monthly.

Moneta Markets is a broker for active and social trading

Moneta Markets provides three account types with ECN/STP order execution. This execution model allows private traders to trade directly with liquidity providers rather than through dealers, which is advantageous due to extremely low spreads. This company offers a wide range of trading instruments, such as currency pairs, CFDs on stocks, bonds, indices, commodities, cryptocurrencies, and ETFs. This broker allows the use of MQL4’s ZuluTrade and DupliTrade for passive income. Investors can copy the trading signals of top traders, cancel trades that seem unprofitable, and deposit and withdraw funds at any time.

Moneta Markets provides several platforms that are suitable for mobile, desktop, and web trading. Also, this broker does not prohibit the use of trading advisors or other strategies.

Useful services offered by Moneta Markets:

-

VPS hosting. The use of a private dedicated server ensures smooth trading even when there are problems with internet and electricity;

-

Economic calendar. It publishes important events that may affect the market situation and prices;

-

Forex trading calculators are tools for calculating the profitability of a potential trade;

-

Support via TeamViewer. If necessary, this company's specialists will help set up this trading platform and resolve other issues by connecting to the client's PC;

-

Moneta TV. It broadcasts TV finance news daily;

-

Trading hours. This tool provides information about market schedules subject to the asset;

-

Spreads and commissions. This is a section with detailed information on spreads and trading fees for available financial instruments.

Advantages:

1,000+ financial instruments are available for trading;

Client funds are segregated from this company's capital and held on accounts with a tier-1 custodial bank;

This company provides useful tools and services to improve trading efficiency;

For partners, there are three programs of passive income on conversions and referral trading volumes;

Multilingual technical support.

All clients can connect to top liquidity providers using oneZero, which is a new mechanism to close trades as quickly as possible.

Moneta Markets offers new clients a 50% cash back bonus. To activate the bonus, traders need to open and fund a live account with $500 or more. Bonus funds are converted into cash by trading Forex, gold, or oil CFDs, with the following conversion rates: 1 lot = $2 on Direct STP accounts and 1 lot = $0.50 on Prime ECN accounts.

Latest Moneta Markets News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i